The Capital One Merger: What You Need to Know Right Now

The financial world is buzzing with big news — the Capital One merger with Discover Financial Services has officially received approval from U.S. regulators. This isn’t just another corporate handshake. It’s a deal that could shake up how millions of Americans use and manage credit.

Valued at $35.3 billion, this all-stock transaction is one of the most significant banking mergers in recent years. It positions Capital One to become a dominant force not just in issuing credit cards but also in payment processing — a move that could rival giants like Visa, Mastercard, and American Express.

From cardholders to small business owners, this merger has the potential to impact your wallet. Here’s a full breakdown of what it means, why it matters, and what you should watch for in the months ahead.

Key Highlights

- Capital One will become the largest credit card issuer in the U.S.

- The merger includes Discover’s global payment network.

- Approval came with regulatory conditions and a $100M fine for Discover.

- Experts warn of potential higher interest rates.

- The deal is expected to close by May 18, 2025.

You can also read our recent articles on Netflix’s Q1 2025, Bitcoin Stays Strong Amid Tariff, Tariff, Trade War and Recession, Nvidia AI Powerhouse, DeepSeek’s AI Power, China’s AI shocks the Tech World

What is the Capital One Merger All About?

At its core, the Capital One merger is about growth, control, and scale.

Capital One is acquiring Discover Financial Services in a massive all-stock deal. The combined company will not only have a stronger portfolio of credit card products but will also own Discover’s payment network — something very few banks have. Most major banks, like JPMorgan and Bank of America, rely on third-party networks like Visa or Mastercard to process transactions. With this deal, Capital One takes a bold step toward becoming more self-reliant and competitive.

The merger also makes Capital One the eighth-largest U.S. bank based on total assets. It expands their customer base, brings in new tech capabilities, and allows them to compete globally.

For consumers, this could mean more rewards, smoother tech experiences, and increased card acceptance. But the deal also raises questions about how it may affect fees, interest rates, and competition.

How Will Capital One Merger Impact Discover Customers?

Discover customers will likely see several changes:

- Increased merchant acceptance, especially for international purchases.

- Access to Capital One’s travel benefits and digital tools.

- A broader variety of financial products under one roof.

That said, transitions of this size don’t happen overnight. While the merger is moving forward, major changes for cardholders could roll out gradually over the next year.

Regulators Add Conditions to the Deal

The merger didn’t come without scrutiny. The Federal Reserve and OCC (Office of the Comptroller of the Currency) approved the deal but added some conditions.

One major requirement: Capital One must submit a plan to correct Discover’s past regulatory violations. This comes after Discover was fined $100 million for overcharging on interchange fees from 2007 to 2023.

Regulators will also continue monitoring the merger to ensure it doesn’t harm consumers or the market.

Will It Affect Interest Rates and Fees?

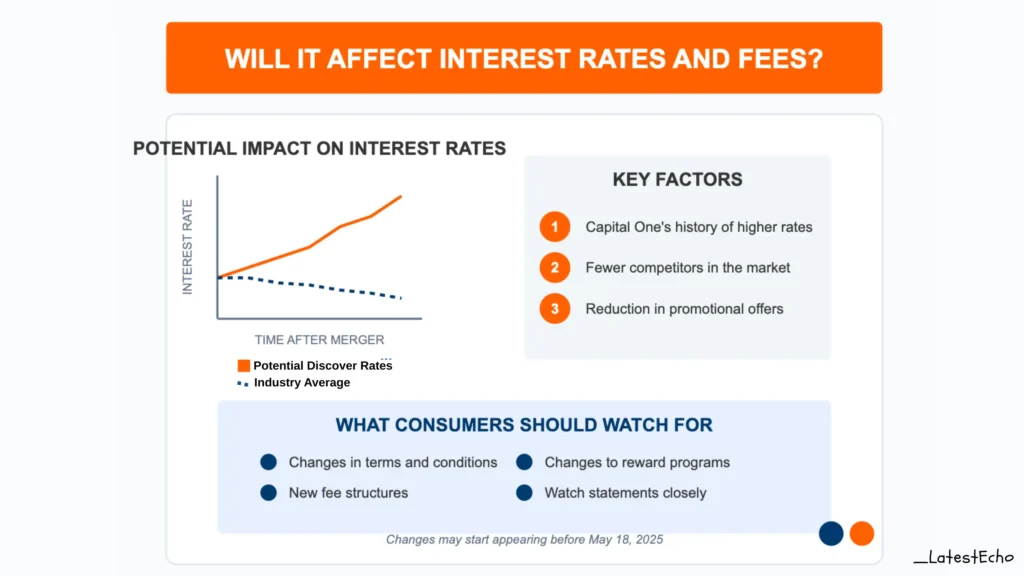

Yes, it could.

Capital One has long focused on serving a wide range of customers, including those with fair or low credit scores. Because of that, its interest rates are usually higher than average. Now, with the merger, it’s possible these higher rates could carry over to Discover products too.

Also, fewer competitors in the credit card space could lead to reduced promotional offers, fewer low-rate options, and more fees. Consumers may have fewer choices when looking for a card that fits their needs.

However, Capital One has also promised to keep its products competitive. So while change is likely, it may not be all bad. Consumers should watch their statements and communication from their issuer closely.

What Does This Mean for the Credit Card Market?

This deal is more than a merger — it’s a market shift.

The most important piece of the puzzle is Discover’s payment network. By owning it, Capital One gains control over how its transactions are processed. This makes Capital One more similar to American Express, which handles both issuing and processing.

That change gives Capital One more power to:

- Negotiate lower transaction fees for businesses.

- Launch new digital services more quickly.

- Improve cardholder rewards by controlling costs.

But industry experts and consumer groups worry about the long-term impact on competition. With fewer companies offering cards and controlling networks, it might become harder for smaller players to survive. This could reduce innovation and increase prices over time.

Conclusion

The Capital One merger with Discover marks a major turning point in U.S. banking and credit card services. For consumers, it offers new possibilities — from better card benefits to wider global access. But it also brings new challenges, such as the risk of higher rates and reduced competition.

Whether you’re a Capital One or Discover customer, now is a good time to stay informed and review your financial products. The merger is set to close in May 2025, but changes may start appearing sooner than you think.

Frequently Asked Questions (FAQs)

1. When will the Capital One merger be completed?

The merger is expected to finalize by May 18, 2025, pending final steps and oversight from regulators.

2. What happens to my Discover card after the merger?

Your card will continue to work. Over time, you may see new features, branding updates, or benefit changes depending on Capital One’s rollout.

3. Could this lead to higher interest rates on my credit card?

It’s possible. Mergers often reduce competition, and Capital One traditionally offers higher rates to subprime borrowers. Watch for changes in your terms.

4. Will Discover’s payment network be phased out?

No, Capital One plans to keep Discover’s network and expand its use. This could improve global acceptance and allow Capital One to lower processing costs.

5. Is this merger good or bad for consumers?

It depends. Some customers may gain better services and rewards. But others could face higher fees and fewer options as the market consolidates.