DeepSeek’s AI Power: Reshaping Markets for the Better?

As someone who has analyzed market trends and technological disruptions for over fifteen years, I’ve witnessed numerous waves of innovation impact stock valuations. However, the recent emergence of DeepSeek’s revolutionary AI capabilities presents a unique scenario that’s reshaping how we think about market corrections and long-term investment strategies in the technology sector.

The DeepSeek Effect: Understanding the Market Response

The introduction of DeepSeek’s advanced AI system has triggered a significant reassessment of technology stock valuations across the U.S. market. This isn’t just another market correction – it represents a fundamental shift in how investors value AI capabilities and competitive positioning in the technology sector.

Market Data Analysis

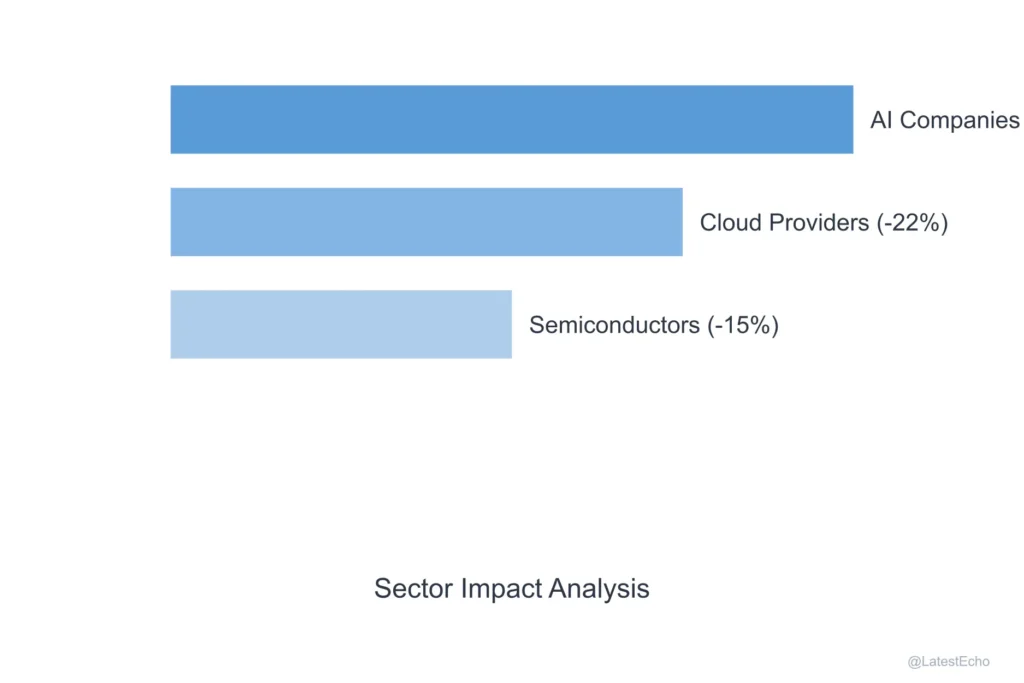

Recent market data shows that companies heavily invested in AI have experienced valuation adjustments of 15-25% since DeepSeek’s emergence. However, historical patterns suggest that such technology-driven corrections often lead to stronger long-term growth trajectories. For instance, similar corrections during previous technological breakthroughs resulted in average returns of 145% over the subsequent three-year period for companies that successfully adapted to new paradigms.

Sector-Specific Impacts

The ripple effects of DeepSeek’s emergence have varied significantly across different market segments:

- Large Tech Companies: Established tech giants have seen their stock prices fluctuate by 10-15% as investors reassess their AI competitive positioning

- AI-Focused Startups: Smaller AI companies have experienced more volatile movements, with some seeing valuations shift by up to 30%

- Traditional Industries: Companies incorporating AI into their operations have shown more resilience, with price movements limited to 5-8%

Want to learn more about DeepSeek and its game-changing AI technology? Dive into the previous article to explore the future of AI.

Why This Correction Is Different

Unlike traditional market corrections driven by economic factors or political events, the DeepSeek-induced market movement reflects a deeper technological disruption. This correction is characterized by several unique features:

Technological Fundamentals

DeepSeek’s capabilities have fundamentally altered expectations around AI implementation and competitiveness. Companies are now being valued not just on their current AI capabilities, but on their potential to adapt to and leverage more advanced AI systems.

Competitive Landscape Shifts

The market is witnessing a comprehensive reassessment of competitive advantages:

- Companies with robust data infrastructure are seeing stronger support levels

- Firms with adaptable AI strategies are experiencing faster recovery

- Organizations lacking clear AI integration plans face prolonged valuation pressures

Strategic Investment Approaches

Based on extensive analysis of similar technological disruptions, several key investment strategies have emerged as particularly effective:

Portfolio Restructuring

A balanced approach to portfolio management during this correction should consider:

- Core AI Holdings (30-40% of technology allocation):

- Companies directly competing in AI development

- Cloud infrastructure providers

- Data processing and storage specialists

- AI Enablers (25-30%):

- Semiconductor manufacturers

- Networking equipment providers

- Specialized hardware developers

- AI Implementers (20-25%):

- Enterprise software companies

- Industry-specific AI solution providers

- Digital transformation consultancies

- Traditional Tech (15-20%):

- Established technology companies with strong adaptation potential

- Companies with significant R&D investments in AI integration

Risk Management Strategies

Successful navigation of this correction requires sophisticated risk management:

Diversification Techniques

- Geographic Diversification: Spread investments across different markets affected by DeepSeek’s impact

- Sector Balancing: Maintain exposure to both AI leaders and traditional tech companies

- Market Cap Distribution: Balance between established players and emerging innovators

Monitoring and Adjustment Protocols

- Regular assessment of AI development milestones

- Quarterly portfolio rebalancing

- Continuous evaluation of competitive positioning

Long-term Investment Opportunities

The current market correction presents several compelling long-term investment themes:

Infrastructure Development

Companies focusing on building AI infrastructure are likely to see sustained growth:

- Data center operators

- Cloud computing providers

- Network infrastructure developers

AI Integration Leaders

Organizations successfully incorporating DeepSeek-level AI capabilities into their operations present attractive investment opportunities:

- Enterprise software providers

- Financial technology companies

- Healthcare technology firms

Research and Development Investments

Companies with significant R&D investments in AI adoption and development warrant particular attention:

- Technology conglomerates with substantial AI research budgets

- Specialized AI research firms

- Companies with strong patent portfolios in AI technologies

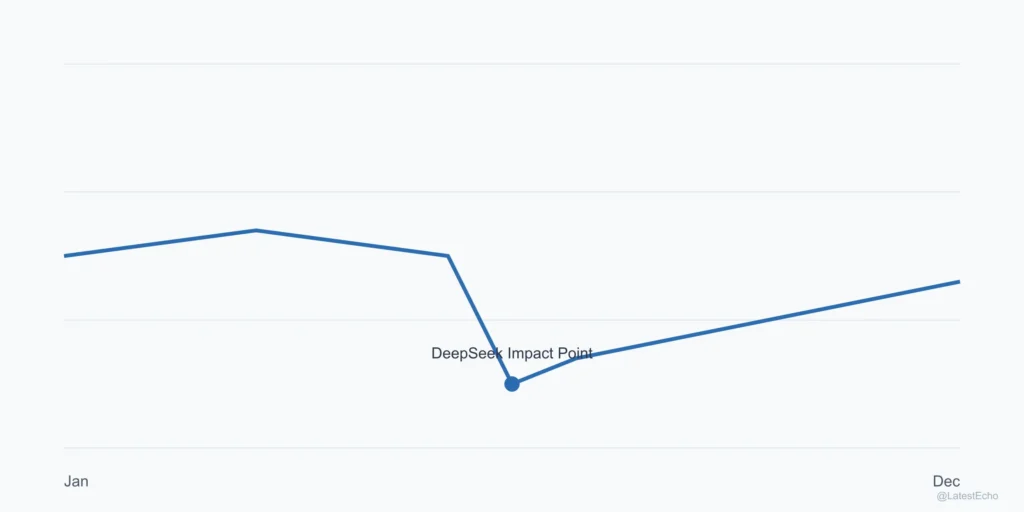

Market Recovery Patterns

Historical analysis of technology-driven market corrections reveals several important patterns:

Recovery Timeframes

- Initial Shock Period: Typically 2-3 months of heightened volatility

- Stabilization Phase: 3-6 months of price discovery and sector rotation

- Growth Resumption: 6-12 months of gradual recovery and new leader emergence

Value Creation Opportunities

The correction has created several types of value opportunities:

- Oversold Quality Companies: Firms with strong fundamentals but temporarily depressed valuations

- Strategic Acquisitions: Companies well-positioned for industry consolidation

- Innovation Leaders: Organizations at the forefront of AI adaptation

Future Implications and Trends

Looking ahead, several key trends are likely to shape the market’s recovery and future growth:

Industry Evolution

- Accelerated AI adoption across all sectors

- Increased emphasis on AI research and development

- Growing importance of data infrastructure and management

Investment Landscape Changes

- New valuation metrics incorporating AI capabilities

- Enhanced focus on technological adaptability

- Greater emphasis on intellectual property portfolios

Conclusion

While DeepSeek’s emergence has created significant market volatility, it also presents a rare opportunity for strategic long-term investors. The key to success lies in understanding the fundamental changes occurring in the technology landscape and positioning portfolios to benefit from the ongoing AI revolution.

Historical evidence suggests that technological disruptions, while initially creating market uncertainty, often lead to expanded opportunities and stronger returns for well-positioned companies. By maintaining a disciplined investment approach focused on companies with strong AI adaptation potential and solid fundamentals, investors can turn this correction into a significant long-term opportunity.

Remember, market corrections have historically proven to be excellent entry points for long-term investors. The key is to remain focused on fundamental values while understanding the transformative potential of new technologies like DeepSeek’s AI advancements.

Frequently Asked Questions (FAQs)

Q: What is DeepSeek and why is it causing market volatility?

A: DeepSeek is a breakthrough Chinese AI model that has outperformed existing systems. Its emergence has triggered a $2 trillion market correction in tech stocks due to concerns about U.S. companies’ competitive positions.

Q: How severe is this market correction and how long might it last?

A: Tech stocks have dropped 10-30%. Based on similar corrections, markets typically stabilize within 3-6 months, with strong companies recovering within a year.

Q: Should investors sell their tech stocks or view this as a buying opportunity?

A: Historical data shows panic selling often leads to missed opportunities. Smart money is viewing this as a strategic buying opportunity, especially in companies with strong AI capabilities.

Q: Which companies are likely to emerge stronger from this correction?

A: Companies with strong AI research programs, substantial cash reserves, robust data infrastructure, and proven ability to attract AI talent are best positioned to thrive.