Nvidia Is the Future of AI—How strong does it stand?

Nvidia (NASDAQ: NVDA) has emerged as the undisputed king of AI computing, transforming the tech industry with revolutionary GPUs, intelligent systems, and unmatched software support. As global markets prepare for potential economic uncertainty, Nvidia’s dominance in artificial intelligence is making headlines — not only for innovation but also for its ability to thrive in tough times.

Armed with ultra-powerful chips, a deep AI software stack, and robust financials, Nvidia is redefining what it means to be recession-resilient in the world of technology.

You can also read our previous articles on DeepSeek’s AI Power, China’s AI shocks the Tech World, and the Best Data Visualization Tools for 2025.

Key Highlights of Nvidia’s AI Strength

Next-Gen AI Chips and Accelerators

Nvidia’s 2025 lineup includes the much-anticipated Blackwell B200 GPU, the successor to the highly successful Hopper architecture. This new chip boasts up to 2.5x performance improvement, unlocking possibilities for generative AI, robotics, self-driving cars, and more.

- Blackwell B200 GPU: Ultra-efficient and powerful for large language models.

- Grace Hopper Superchip: Combines CPU + GPU for high-performance workloads.

- H100 Tensor Core GPU: Still dominant in training and inference for AI applications.

CUDA Ecosystem and Developer Tools

Nvidia’s software stack is the backbone of its AI dominance. CUDA, TensorRT, and cuDNN are widely adopted across the AI industry.

- CUDA: Over 4 million developers use it for parallel computing.

- Nvidia AI Enterprise: Provides enterprise-ready AI tools for cloud and data centers.

- Omniverse & Isaac: Powering digital twins, robotics, and simulation AI.

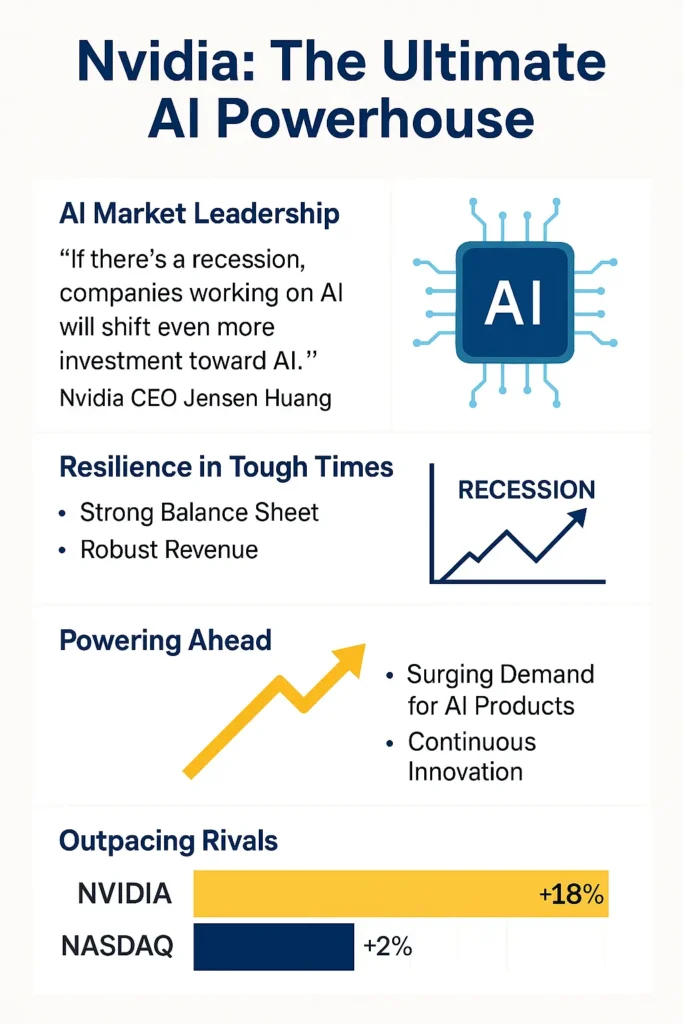

Recession-Resilient Strategy: Why Nvidia Stays Strong

CEO Jensen Huang made it clear at GTC 2025: even in a downturn, AI investment won’t stop. In fact, automation and optimization become more essential during recessions.

“Every CEO is figuring out how to transition into an AI company,” Huang stated.

Why Nvidia Thrives During a Recession

- AI as a Cost-Saving Tool: Automates repetitive tasks and reduces labor costs.

- Enterprise Dependence on AI: Mission-critical services now rely on accelerated computing.

- Massive Demand for AI Infrastructure: From governments to startups, everyone is scaling.

Nvidia vs Competitors: The AI Market Showdown

| Feature | Nvidia (NVDA) | AMD | Intel |

|---|---|---|---|

| Market Cap | $2.8 Trillion | $345 Billion | $195 Billion |

| Leading AI Chip | Blackwell B200 | Instinct MI300X | Gaudi 3 |

| Software Ecosystem | CUDA, TensorRT | ROCm | OneAPI |

| Cloud AI Partnerships | AWS, Azure, Google | Few | Minimal |

| AI Market Share (2025) | ~75% | ~15% | ~7% |

With unmatched market share and end-to-end AI capabilities, Nvidia leads not just in performance — but in influence.

Nvidia and Global Trade: Tariffs and Supply Chain Strategy

While global tariffs and U.S.-China tech tensions pose a risk, Nvidia is actively diversifying its supply chain to ensure minimal disruption.

- Expanding in Taiwan, India, and the U.S.

- Building domestic R&D hubs for AI development

- Working with U.S. trade authorities to manage export restrictions

Despite tighter export controls to China, demand from U.S., EU, and Middle Eastern markets continues to surge — keeping NVDA’s momentum strong.

Nvidia’s Financial Foundation: Built for Stability

Even in turbulent markets, Nvidia boasts some of the strongest financials in tech.

| Metric | Value (Q1 2025) |

|---|---|

| Revenue (TTM) | $85.3 Billion |

| Free Cash Flow (TTM) | $60.9 Billion |

| Gross Margin | 74.99% |

| Cash & Equivalents | $8.5 Billion |

| Long-Term Debt | $8.6 Billion |

With record-breaking revenue and minimal debt, Nvidia is in a prime position to weather any economic storm.

What’s Coming Next from Nvidia?

2025 & Beyond: Roadmap Highlights

- Blackwell B200 Launch: Built for generative AI, with full-scale deployment expected by Q3 2025.

- AI Robotics Revolution: Collaborations with humanoid robotics labs to integrate real-time AI control.

- Omniverse Expansion: More companies are building digital twins to simulate factories, cities, and ecosystems.

Conclusion: Should You Bet on Nvidia Now?

Nvidia is more than just a chipmaker — it’s the AI infrastructure of the modern world. With groundbreaking innovation, a strong financial base, and resilience in times of recession, NVDA remains one of the smartest tech stocks of the decade.

Whether you’re a long-term investor or a tech enthusiast, Nvidia is undeniably shaping the future of AI.

Frequently Asked Questions (FAQ) About Nvidia

Q1: What makes Nvidia the leader in AI chips?

Its combination of hardware (like the B200 GPU) and proprietary software (CUDA, TensorRT) makes it irreplaceable in AI workflows.

Q2: Is Nvidia impacted by U.S.-China tariffs?

While tariffs affect exports, Nvidia has diversified operations and remains in high demand in global markets.

Q3: How does Nvidia’s AI technology help during a recession?

By enabling automation and optimization, Nvidia’s tech helps companies cut costs and stay efficient.

Q4: What is Nvidia’s Blackwell chip?

The Blackwell B200 is Nvidia’s next-gen GPU designed to power generative AI and advanced LLMs.

Q5: Should I invest in NVDA now?

Analysts believe Nvidia’s strong fundamentals and AI dominance make it a solid long-term investment.