September Effect: Is the Market Really Doomed This Month?

Brace yourselves, investors! As the leaves start to turn and pumpkin spice lattes make their annual comeback, there’s another fall tradition that has Wall Street on edge. The infamous September Effect in Stock. September has earned a reputation as the worst month for stock market performance. This trend is often called the “September Effect.” It’s true! Since 1928, the S&P 500 has averaged a 1% decline during this seemingly cursed month. Data shows that this month consistently experiences more market declines compared to others. Several factors drive this pattern, including investor behavior and seasonal trends.

Many investors rebalance their portfolios after the summer, triggering a wave of sell-offs. The lack of significant economic reports in late summer creates uncertainty, further amplifying this effect. Additionally, investors often prepare for potential year-end volatility by de-risking portfolios.

In this article, we’ll dive deep into the September Effect. Exploring its history, potential causes, and how savvy investors can turn this challenge into an opportunity. So grab your favorite fall beverage, and let’s unravel this financial phenomenon together!

Embracing the September Shift

In the world of finance, September Effect refers to the historical tendency for stock markets to perform poorly during the month of September. It’s as if the markets are suffering from a collective case of the back-to-school blues!

One of the key reasons for September’s historical underperformance is the shift in market sentiment. After the summer months, trading activity tends to pick up, and investors begin to reconsider their strategies for the rest of the year. With fewer earnings reports or economic indicators in August, market participants are often left waiting for signals in September. This information gap contributes to increased caution and defensive moves, leading to price drops.

Theories Behind the September Effect

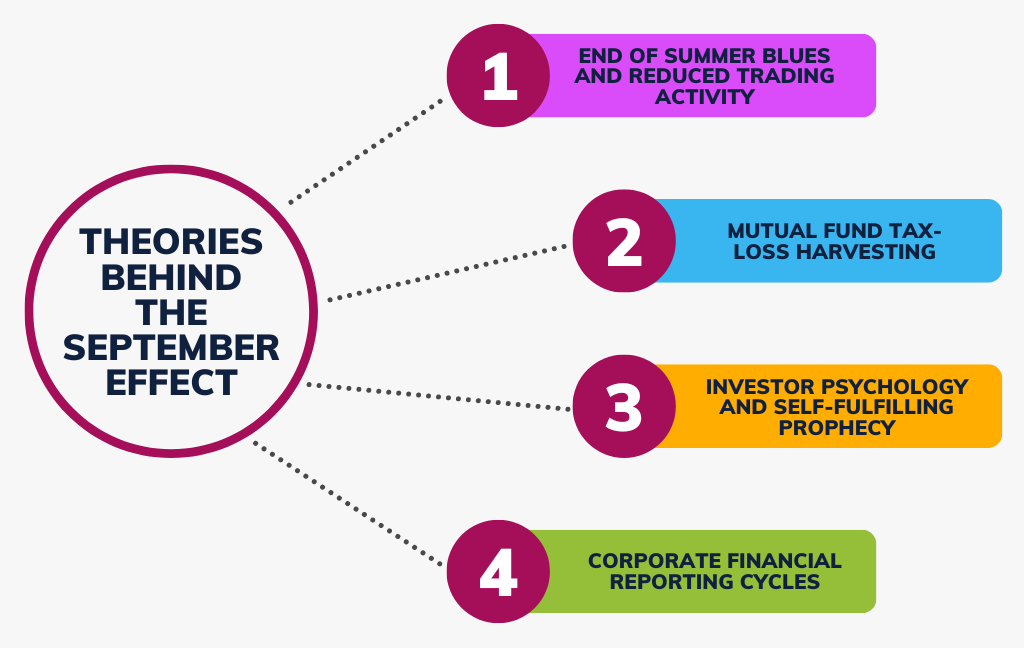

The September Effect, known for its historically poor stock market performance, often unsettles investors. The “summer blues” theory explains this dip by suggesting that as investors return from vacations, the market’s diminished liquidity and lower trading volume create heightened volatility. This transition can make September a particularly nerve-wracking month, as the market struggles to regain its usual energy and stability.

Another theory points to mutual fund tax-loss harvesting. As many funds end their fiscal year in September and sell underperforming stocks to offset gains. Additionally, the self-fulfilling prophecy theory proposes that investor expectations of poor performance in September actually contribute to the downturn.

Other factors potentially contributing to the September Effect include corporate financial reporting cycles. As many companies release year-end reports during this period, it potentially impacting market sentiment. Seasonal economic shifts, such as back-to-school spending and preparation for the holiday season, also play a role in market behavior.

While these theories offer plausible explanations, it’s important to note that the stock market is influenced by a complex interplay of factors. There is no any single theory that can fully account for its behavior. Investors should consider the September Effect as one of many factors in their overall investment strategy. While, maintaining a long-term perspective rather than making decisions based solely on seasonal patterns.

Investor Behavior and the September Effect

The September Effect is largely a result of investor psychology. Many investors, especially institutional ones, start selling off assets in preparation for the fourth quarter, which includes critical events like year-end tax planning and portfolio adjustments. This wave of selling adds downward pressure on stock prices, which can cause short-term volatility.

Is the September Effect in Stock Real or Just a Coincidence?

Some theories suggest investor behavior and fiscal year-end planning contribute to this trend. However, many experts view it as a statistical coincidence, citing broader market forces like economic data and geopolitical events.

Recent years have shown mixed September results, with gains in some cases, challenging the assumption that the month is always negative for stocks. As global market dynamics and trading strategies evolve, the September Effect in stock has become less predictable, underscoring the importance of diversifying investments and focusing on long-term market factors.

How to Navigate the September Effect in 2024

To navigate the September Effect in 2024, investors can focus on diversification strategies to spread risk across different asset classes, reducing exposure to potential market downturns. Sector rotation, particularly shifting towards defensive stocks like utilities or consumer staples, can offer stability during volatile periods.

Another approach is dollar-cost averaging, where consistent investments are made regardless of market conditions, smoothing out short-term fluctuations. Additionally, market dips in September can present opportunities for long-term investors to buy quality stocks at lower prices, capitalizing on potential rebounds in the months ahead.

Does the September Effect in Stock Always Occur?

While the September Effect in stock is a well-documented trend, it does not happen yearly. Some Septembers experience gains, depending on broader market conditions. However, the historical data shows that September has a higher likelihood of market declines compared to other months.

Opportunities Amid Volatility of the September Effect

For investors, the September Effect isn’t just about risks—it also presents opportunities. Short-term traders may capitalize on volatility, while long-term investors might find attractive entry points into stocks that dip during this period. The key is to remain vigilant and not let short-term market swings cloud long-term goals.

Conclusion

As we’ve explored, the September Effect in stock is a recurring phenomenon that investors should be aware of. While historical data shows a tendency for stocks to underperform during this month, it’s crucial to remember that past performance doesn’t guarantee future results.

By understanding the underlying causes, such as portfolio adjustments and seasonal trends, investors can better navigate this challenging month and potentially find opportunities amid the volatility. Remember, every market dip presents an opportunity for long-term investors. So, as we head into September 2024, keep your eyes on the horizon, stay diversified.

For an in-depth informations and latest updates on cutting-edge technology, keep on visiting our website. Stay informed with our newest trends and insights in tech. You can also explore the latest apple launch event where iPhone 16 Series: A New Era of AI-Powered Innovation was displayed, and also Netflix TV App Redesigns its new Homepage Layout.