Could Tariffs Lead to Economic Collapse? Is the U.S. on the Edge of Recession?

In 2025, the U.S. economy faces a fresh wave of uncertainty. The Trump administration’s aggressive tariffs strategy—meant to bolster American manufacturing—has triggered renewed concerns of a recession. As costs rise and supply chains falter, consumers and businesses alike are starting to feel the squeeze.

This article explores the impact of tariffs on the U.S. economy, how they influence recessionary trends, and what it actually takes to officially declare a recession.

Key Highlights

- 📉 How tariffs increase recession risks by disrupting global trade and raising consumer prices.

- 💼 Expert insights from economists and investment banks forecasting economic slowdowns.

- 🇺🇸 Understanding who declares a U.S. recession and how it’s officially measured.

- 🏭 Industries most impacted by tariffs, including manufacturing, retail, and agriculture.

- 📊 Historical context of how tariffs have influenced past economic downturns like the Great Depression.

You can also read our previous articles on Nvidia AI Powerhouse, DeepSeek’s AI Power and China’s AI shocks the Tech World

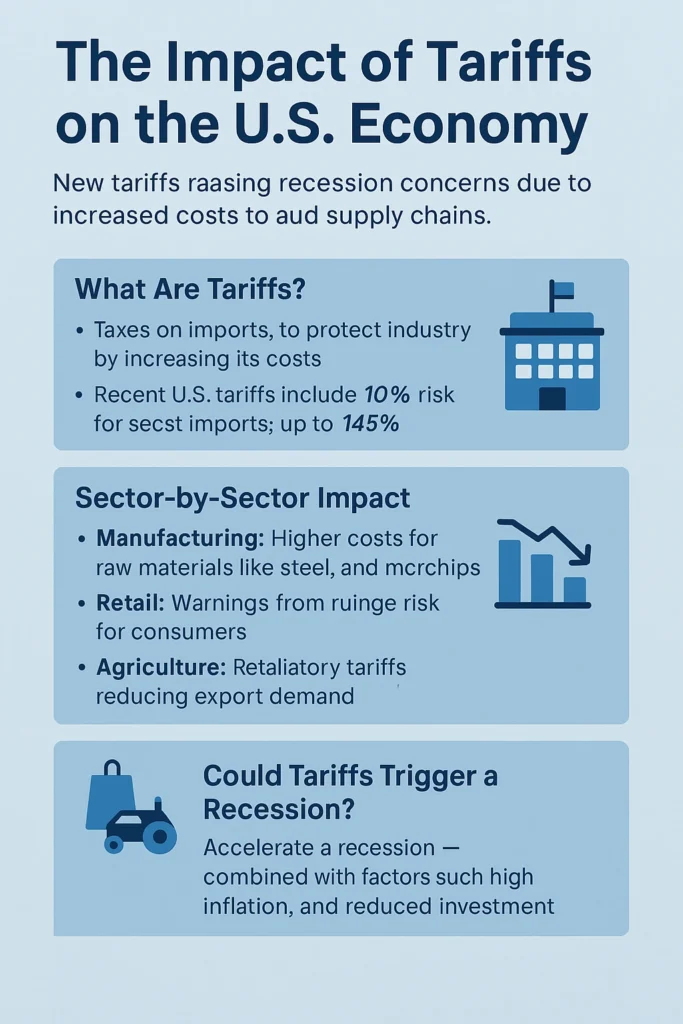

What Are Tariffs and Why Are They Imposed?

Tariffs are taxes levied by a government on imported goods. The primary intent is to make foreign products more expensive, encouraging consumers to buy domestically produced alternatives. While tariffs may protect some local industries in the short term, they often carry broader economic consequences that ripple across sectors.

In early 2025, the U.S. introduced a new wave of tariffs—10% across most imports and up to 145% on selected goods from major trade partners like China, Germany, and Mexico. These policies have already led to costlier goods, strained diplomatic ties, and growing fears of global economic fragmentation.

The Immediate Economic Fallout

Economists and market analysts were quick to respond. Within a week of the tariff announcement:

- Goldman Sachs raised its recession risk forecast from 35% to 45%.

- JPMorgan pushed the global recession probability to 60%, up from 40%.

- Consumer Google searches for “recession” surged, signaling widespread anxiety.

Financial markets have grown increasingly volatile. The S&P 500 dropped nearly 4% in a single week, and tech stocks—heavily reliant on foreign components—led the decline.

The Impact of Tariffs on the U.S. Economy: Sector-by-Sector Breakdown

1. Tariffs on Manufacturing and Automotive

Manufacturers reliant on imported raw materials such as steel, aluminum, and microchips now face elevated costs. Automakers, in particular, are at risk. According to the Alliance for Automotive Innovation, the cost of building a car in the U.S. has increased by over $1,300 per unit due to tariffs on imported components.

Production slowdowns, layoffs, and delayed model rollouts are already being reported by some manufacturers.

2. Tariffs on Retail and Consumer Goods

American retailers, especially those selling imported electronics, clothing, and household items, are seeing narrower profit margins. Major chains like Walmart and Target have warned of higher prices on everyday essentials, potentially impacting low- and middle-income households the most.

3. Tariffs on Agriculture and Food Supply

American farmers are facing the double blow of reduced export demand and increased costs for equipment and feed. China, a major buyer of U.S. soybeans and corn, has imposed retaliatory tariffs—choking off critical revenue streams.

Domestically, the cost of food staples such as dairy, eggs, and grains is rising. According to the USDA, grocery prices have gone up by 5.7% year-over-year—largely influenced by tariff-related supply chain issues.

Consumer Behavior: The Tipping Point

One of the earliest signs of a weakening economy is a shift in consumer behavior. As tariffs drive up prices, Americans are already:

- Cutting discretionary spending: Travel, entertainment, and dining out have all seen notable slowdowns.

- Shifting to budget brands: Discount retailers and dollar stores are seeing increased foot traffic.

- Delaying major purchases: Car sales, home renovations, and electronics purchases are stalling.

When consumers start to spend less, businesses earn less—leading to layoffs and reduced investment. This cycle is exactly what economists fear could trigger the next recession.

What Constitutes a Recession— Tariffs? and Who Declares It?

Contrary to popular belief, a recession isn’t declared by a drop in the stock market or just two quarters of negative GDP growth. In the U.S., the official designation comes from the National Bureau of Economic Research (NBER), specifically its Business Cycle Dating Committee.

The NBER defines a recession as a “significant decline in economic activity spread across the economy, lasting more than a few months.” They consider multiple indicators:

- Real GDP

- Employment levels

- Industrial production

- Real income

- Consumer spending

NBER usually waits several months after a downturn begins before making an official call to ensure accuracy.

Are Tariffs Alone Enough to Trigger a Recession?

While tariffs are not always the sole cause of a recession, they can be a powerful accelerant when combined with other factors like high inflation, geopolitical instability, and tight credit conditions.

In this case, tariffs are:

- Driving up input costs and consumer prices

- Reducing international demand for U.S. goods

- Slowing down business investment and hiring

- Creating uncertainty that stifles market confidence

If these trends continue, the combination could easily tip the economy into contraction.

A Look Back: Historical Lessons on Tariffs and Recessions

The Great Depression (1930s)

One of the most infamous examples is the Smoot-Hawley Tariff Act of 1930, which raised U.S. tariffs on over 20,000 imported goods. This move triggered international retaliation and helped deepen the Great Depression by strangling global trade.

The 2018–2019 U.S.-China Trade War

During President Trump’s first term, similar tariffs were imposed, resulting in global market volatility and a near-recession in manufacturing. According to a Federal Reserve study, the trade war cost the U.S. about 300,000 jobs and reduced GDP growth by 0.3%.

Conclusion: Where Does the U.S. Go From Here?

The impact of tariffs on the U.S. economy is undeniable. While the intention behind protectionist policies may be to shield American industries, the unintended consequences—rising consumer costs, strained trade relationships, and economic uncertainty—can far outweigh the benefits.

With recession fears mounting, the road ahead depends on several factors:

- Will the administration revise or ease tariffs under mounting pressure?

- Can the Federal Reserve counterbalance inflation without triggering further slowdown?

- Will global trade partners seek resolution or escalate retaliatory measures?

For now, the best course of action for consumers and businesses is to stay informed, manage spending cautiously, and prepare for economic turbulence ahead.

Frequently Asked Questions (FAQ)

1. What is the main impact of tariffs on the U.S. economy?

Tariffs raise import prices, which can lead to higher consumer costs, disrupted supply chains, and slower economic growth.

2. Can tariffs trigger a recession?

Yes. Tariffs can reduce consumer spending and business investment, increasing the risk of a recession when combined with other economic stressors.

3. Who decides if the U.S. is in a recession?

The National Bureau of Economic Research (NBER) officially declares recessions based on economic data like GDP and employment.

4. Which sectors are most affected by tariffs?

Industries such as automotive, manufacturing, agriculture, and retail are especially vulnerable due to global supply chain reliance.

5. Do consumers feel the effects of tariffs?

Yes. Tariffs often lead to price hikes on everyday items, reducing purchasing power and confidence.