Blaize Launches AI Chip IPO, Ushering in a New Era

In a groundbreaking development for the AI chip industry, Blaize, the California-based edge computing specialist, is set to become the first AI chip startup to go public in 2025. The company, founded by former Intel engineers, announced its plans for a SPAC merger that will see it listed on the Nasdaq exchange, marking a significant milestone in the evolving landscape of AI hardware innovation.

Highlights:

- Explore Blaize’s journey from startup to public company, including its $335 million funding history and strategic partnerships with industry giants.

- Understand the company’s edge computing focus and how it differentiates itself from data center-centric competitors like Nvidia.

- Learn about Blaize’s financial performance, market opportunities, and ambitious growth plans in the AI chip sector.

- Discover the implications of this IPO for the broader AI hardware industry and future market trends.

The Rise of an AI Chip Pioneer

Founded in 2011, Blaize has emerged as a notable player in the edge AI computing space, distinguishing itself from traditional data center-focused chip manufacturers. The company’s impressive journey has been backed by industry heavyweights, with Samsung and Mercedes-Benz among its key investors, contributing to a total funding pool of $335 million.

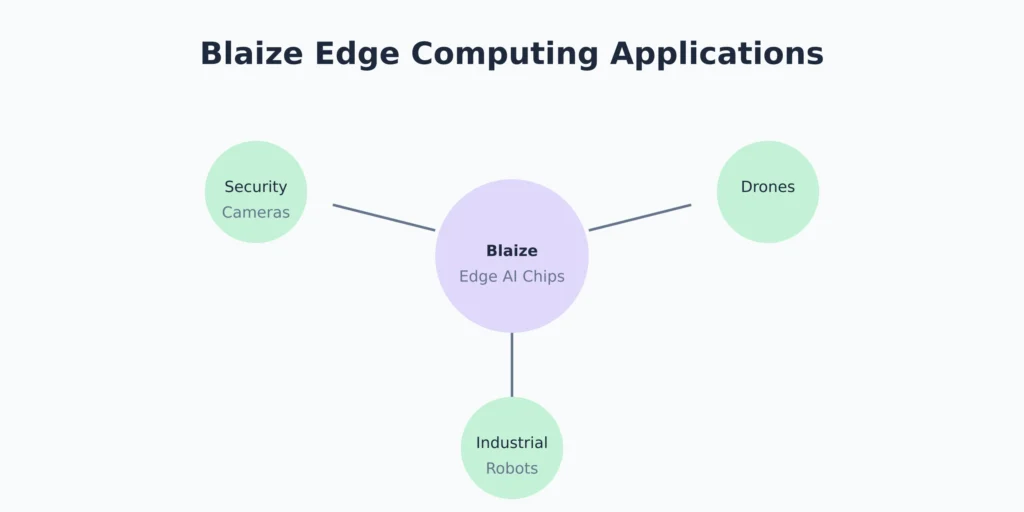

Unlike industry giant Nvidia, which dominates the data center market, Blaize has carved out its niche in edge computing applications. Their chips are specifically designed for integration into smart devices like security cameras, drones, and industrial robots, offering solutions that prioritize power efficiency and real-time processing capabilities.

Financial Landscape and Growth Prospects

Despite current financial metrics showing losses of $87.5 million on revenue of $3.8 million in 2023, Blaize’s future looks promising. CEO Dinakar Munagala, drawing from his 12-year experience at Intel, explains that substantial initial investments are typical in the chip industry: “As a chip company, you make massive investments upfront, but when the hockey stick growth comes, it climbs rapidly.”

The company’s pipeline tells an encouraging story, with approximately $400 million in potential deals under negotiation. A particularly notable opportunity includes a $104 million purchase order from an EMEA defense entity, highlighting the growing demand for AI chip solutions in security and defense applications.

Market Position and Competitive Edge

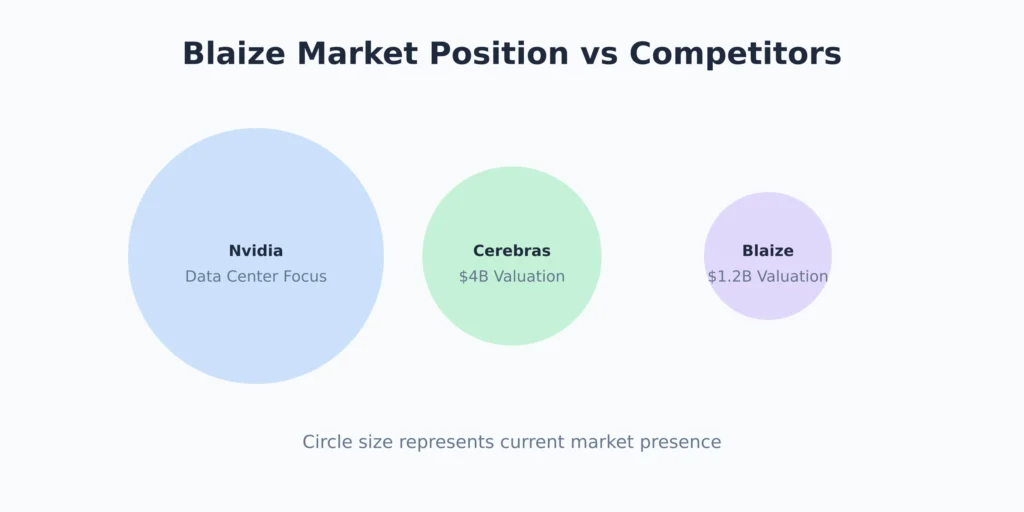

Blaize’s anticipated $1.2 billion post-SPAC merger valuation positions it uniquely in the market. While this figure may seem modest compared to competitors like Cerebras, which sought a $4 billion valuation in its IPO filing, their focus on edge computing applications sets it apart in a less crowded market segment.

The company’s strategy aligns with growing market demands for edge AI solutions. As Munagala notes, “While all the AI hype centers on data centers, there’s a vast untapped market in real-world applications that directly impact people’s lives and generate revenue today.”

Manufacturing and Innovation Strategy

A key differentiator for Blaize is its commitment to U.S.-based manufacturing, a strategic decision that could prove valuable amid growing concerns about supply chain security and technological sovereignty. This approach, while capital-intensive initially, positions the company favorably for future growth and potential government contracts.

The company’s innovation strategy focuses on developing chips that excel in three critical areas: power efficiency, low latency, and enhanced data privacy. These features are particularly crucial for edge computing applications where real-time processing and security are paramount.

Future Outlook and Industry Implications

Blaize’s public debut could mark the beginning of a new era for AI chip startups. As the first such company to go public in 2025, it will likely set important precedents for others in the pipeline. The success or challenges of this IPO could influence how investors view similar companies in the edge computing space.

The timing of Blaize’s market entry coincides with growing demand for edge AI solutions across various sectors, from autonomous vehicles to smart cities. This market timing, combined with the company’s focused strategy and strong pipeline, positions it well for potential growth.

Industry Partnerships and Ecosystem Development

Beyond its core chip development, Blaize has been actively building a robust ecosystem of partnerships. The company has established collaborations with major software developers and system integrators, ensuring their chips can be easily integrated into existing infrastructure. Notable partnerships include agreements with European automotive suppliers and Asian electronics manufacturers, expanding their global reach.

“The key to success in the AI chip industry isn’t just about hardware performance,” explains Dr. Sarah Chen, Principal Analyst at AISemi Research. “It’s about creating a complete ecosystem that makes it easy for customers to implement your technology. Blaize’s partnership strategy shows they understand this fundamental market requirement.”

Impact on Regional Tech Development

Blaize’s decision to manufacture in the United States aligns with recent government initiatives to strengthen domestic semiconductor production. The CHIPS Act, which allocated $52 billion for semiconductor research and manufacturing, creates a favorable environment for companies like Blaize. This positioning could lead to potential government contracts and subsidies, further strengthening their market position.

Technical Differentiation in the Market

One of there key technical advantages lies in their proprietary Graph Streaming Processor (GSP) architecture. This innovative approach allows for more efficient processing of AI workloads at the edge, consuming up to 50% less power than traditional solutions while maintaining high performance levels.

Market analysts have noted that this architecture is particularly well-suited for emerging applications in smart retail, automated inspection systems, and intelligent transportation. According to recent market research by EdgeAI Insights, these sectors are expected to grow at a CAGR of 37% through 2028, representing a potential $45 billion market opportunity.

Investment Community Response

Early responses from the investment community have been cautiously optimistic. “While Blaize’s current financials might raise some eyebrows, their technology roadmap and market positioning are compelling,” notes Marcus Thompson, Senior Partner at Tech Ventures Capital. “The edge AI computing market is still in its early stages, and Blaize’s first-mover advantage could be significant.”

Global Market Dynamics

The global context for Blaize’s IPO is particularly interesting, given the increasing competition from international players. Chinese companies like Horizon Robotics and Cambricon are making significant strides in edge AI chips, while European firms such as Silicon Austria Labs are developing competing solutions. However, their focus on high-security applications and U.S.-based manufacturing gives them unique advantages in Western markets.

Environmental and Sustainability Impact

An often-overlooked aspect of edge AI computing is its potential environmental impact. Blaize’s chips, designed for power efficiency, could contribute to reducing the carbon footprint of AI applications. Traditional cloud-based AI solutions often require significant energy for data center operations and data transmission. Edge computing can reduce this environmental impact by processing data locally, aligning with growing corporate sustainability initiatives.

Conclusion

Blaize’s upcoming IPO represents more than just another company going public; it symbolizes the maturing of the edge AI computing market. While the company faces challenges, including current unprofitability and intense competition, its focused strategy and strong pipeline suggest potential for significant growth.

As AI continues to move from centralized data centers to edge devices, Blaize’s position as a pioneer in this space could prove advantageous. For investors and industry observers alike, this IPO offers a unique opportunity to gauge the market’s appetite for specialized AI chip manufacturers focused on real-world applications.

The success of this public offering could pave the way for other AI chip startups, potentially catalyzing a new wave of innovation in edge computing solutions. As the first AI chip startup to test the public markets in 2025, Blaize’s journey will be closely watched by industry stakeholders and could shape the future landscape of AI hardware investment.

You may also read about the latest growing topics like Generative AI, AI in Healthcare, How Apple Siri Lawsuit Settlement Signals a New Era in Privacy Law.

Frequently Asked Questions

What is Blaize, and what does the company specialize in?

Blaize is a California-based AI chip startup focusing on edge computing, enabling AI processing directly on devices like drones and security cameras.

How is Blaize going public?

Blaize will go public via a SPAC merger with BurTech Acquisition Corp., listing on Nasdaq under “BZAI” and “BZAI.W.”

How does Blaize differ from Nvidia?

Unlike Nvidia, which focuses on data centers, Blaize specializes in low-power AI chips for edge devices, emphasizing real-time processing and efficiency.

What is Blaize’s financial outlook?

Despite losses in 2023, Blaize has a $400 million deal pipeline and a $104 million defense order, signaling growth potential.

Who are Blaize’s key investors?

Blaize has raised over $330 million from major investors like Samsung and Mercedes-Benz AG.