XRP Surges $3.35: A New Era for Crypto Payments?

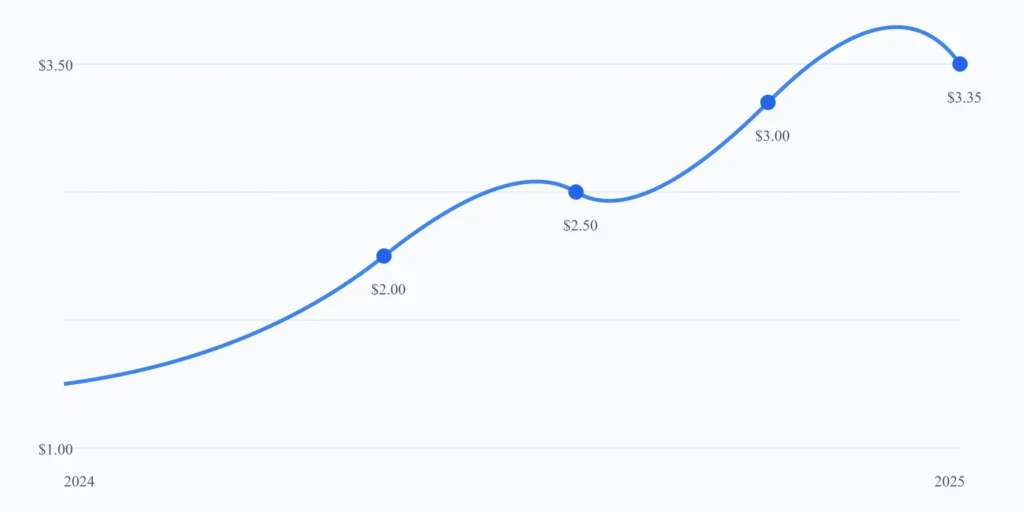

As of January 16, 2025, XRP has experienced a significant price surge, surpassing the $3 mark and reaching an all-time high of $3.35. This increase is attributed to several factors, including positive regulatory developments, increased institutional adoption, and broader market trends in the cryptocurrency space.

XRP’s Historic Price Surge and Market Influence

- XRP recently surpassed the $3 threshold, with its price reaching $3.35 as of January 16, 2025. MoneyCheck

- Contributing factors to this surge include positive regulatory outcomes and anticipation of broader cryptocurrency exchange-traded products (ETPs). Fortune

- XRP’s market capitalization now positions it as the third-largest cryptocurrency by value. MarketWatch

- Technical analysis suggests the potential for further upward momentum, with resistance levels near $4.40. Barron’s

The Evolution of XRP in the Crypto Landscape

Launched in 2012, XRP was created as a digital asset designed to facilitate cross-border payments with minimal transaction fees and near-instant settlements. Ripple Labs, the parent company behind XRP, has consistently positioned it as a superior alternative to traditional payment systems like SWIFT. Unlike decentralized competitors like Bitcoin, this cryptocurrency operates on a consensus ledger protocol rather than proof-of-work, ensuring faster transactions with lower energy consumption. This technological advantage has made it a preferred choice for banks and financial institutions seeking efficient payment solutions.

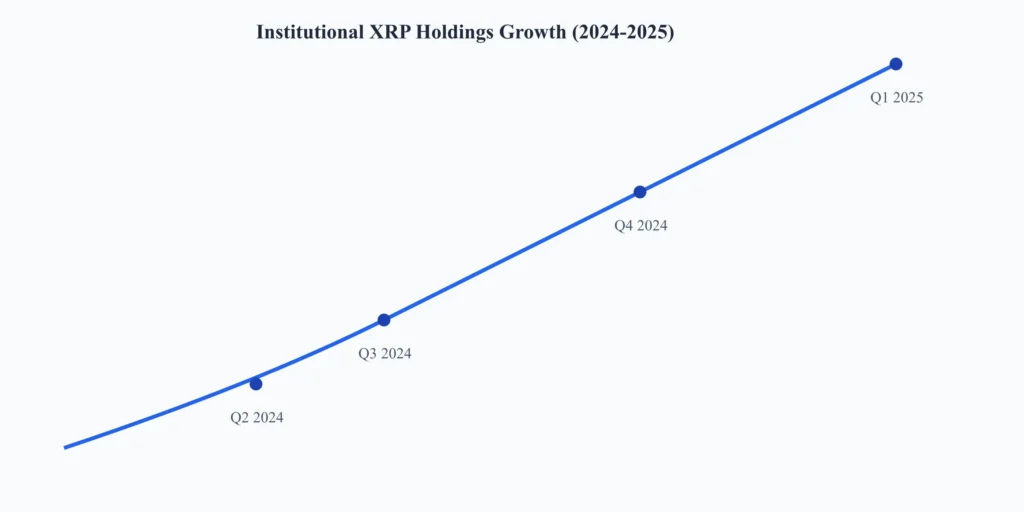

Macroeconomic Impact and Institutional Adoption

XRP’s recent price surge has been closely linked to broader economic factors, including declining U.S. core inflation rates and the Federal Reserve’s potential interest rate cuts. These factors have generally favored alternative assets, including cryptocurrencies, as investors seek hedges against traditional market volatility. Additionally, increased institutional interest has played a crucial role in the currencies growth. Major financial institutions have integrated XRP for cross-border payments, enhancing its real-world utility and market confidence.

Regulatory Developments and Legal Clarity

A pivotal factor in XRP’s recent rally is the positive outcome of Ripple Labs’ legal battle with the U.S. Securities and Exchange Commission (SEC). In a landmark decision in July 2023, the court ruled that XRP is not a security when sold on public exchanges, though institutional sales were deemed securities transactions. This ruling provided much-needed regulatory clarity, reducing uncertainty for investors and boosting market sentiment. Legal clarity has also paved the way for more exchanges to relist this cryptocurrency, further increasing its accessibility and demand.

Financial Performance and Market Position

As of January 2025, XRP’s market capitalization exceeds $150 billion, making it the third-largest digital asset by market value. Recent price movements have been accompanied by significant trading volumes, indicating strong market interest and liquidity. It’s performance has also sparked interest in derivatives markets, with funding rates stabilizing at 13%, reflecting balanced sentiment among futures traders.

Technical Analysis and Price Predictions

Technical analysts point to several bullish indicators suggesting further upside potential for XRP. Key resistance levels are identified at $3.50 and $4.40, while support levels remain near $2.80. If the current momentum holds, analysts predict a potential test of the $5 mark by Q2 2025. However, as with all cryptocurrencies, this currency also remains subject to volatility. External factors, including regulatory changes and macroeconomic shifts, could impact future price movements.

Technological Advancements and Utility Expansion

Ripple Labs continues to innovate within the blockchain space. Recent developments include the launch of a native stablecoin, RLUSD, aimed at facilitating liquidity on the XRP Ledger. Additionally, the platform has introduced smart contract capabilities, expanding its use case beyond cross-border payments to include decentralized finance (DeFi) applications. It’s unique consensus protocol also ensures energy efficiency, consuming significantly less power compared to Bitcoin and Ethereum, making it a sustainable choice for institutional adoption.

Regional Adoption and Market Dynamics

XRP’s adoption varies significantly across regions. In Asia, countries like Japan and Singapore have embraced the asset for financial transactions, while the U.S. and Europe have seen growing institutional adoption following the regulatory clarity achieved in 2023. Emerging markets, particularly in Africa and Latin America, have also begun leveraging this currency for remittance services, capitalizing on its low fees and fast settlement times.

Environmental Considerations and Sustainability

In contrast to energy-intensive proof-of-work systems, XRP’s consensus mechanism is far more sustainable, requiring minimal computational power to validate transactions. This eco-friendly design has attracted environmentally conscious investors and institutions seeking sustainable blockchain solutions.

Investment Outlook and Risk Factors

While XRP’s recent surge presents significant growth potential, it is essential to consider the inherent risks associated with cryptocurrency investments. Regulatory changes, market manipulation, and broader economic factors can introduce volatility. However, it’s clear use case in financial systems, legal clarity, and expanding technological infrastructure position it as a compelling long-term investment for those seeking exposure to the digital asset market.

Network Security and Infrastructure Development

The robustness of XRP’s network infrastructure has played a crucial role in maintaining stability during periods of high transaction volume. This currencies Ledger’s unique consensus mechanism has consistently demonstrated its ability to handle increased loads without compromising security or performance. In recent stress tests, the network successfully processed over 1,500 transactions per second while maintaining sub-4-second settlement times.

The development team has also implemented several significant security enhancements over the past year. These include improved validator node verification processes and enhanced cryptographic protocols that further strengthen the network against potential attacks. The introduction of a new multi-signature framework has provided institutional users with additional security options for managing large crypto holdings.

Integration with Traditional Banking Systems

Traditional banking institutions have shown increasing interest in XRP’s potential to revolutionize their operations. Several major banks have moved beyond pilot programs to full implementation of this currency based settlement systems. The cost savings have been substantial, with some institutions reporting up to 60% reduction in cross-border transaction costs.

One particularly noteworthy development has been the integration of this currency with central bank digital currency (CBDC) initiatives. Several central banks are exploring the use of this technology as a bridge currency between different CBDCs, potentially creating a more interconnected global financial system.

DeFi Ecosystem Evolution in XRP

The XRP ecosystem has experienced significant growth in decentralized finance applications. The introduction of smart contract functionality has catalyzed the development of lending platforms, decentralized exchanges, and yield farming protocols specifically designed for this specific cyptocurrency Ledger. This expansion into DeFi has created new use cases for this particular currency beyond its traditional role in cross-border payments.

Notable developments include:

- The emergence of XRP-based lending protocols with competitive interest rates

- Decentralized exchanges offering advanced trading features

- Yield optimization platforms leveraging XRP’s fast settlement times

- Integration with cross-chain bridges enabling seamless asset transfers

You may also read about the latest growing topics like Generative AI, AI in Healthcare, How Apple Siri Lawsuit Settlement Signals a New Era in Privacy Law, Blaize IPO.

Tokenization and Asset Representation

XRP Ledger’s native tokenization capabilities have opened new possibilities for asset representation on the blockchain. Real estate, commodities, and even carbon credits are being tokenized on the platform, creating new markets and investment opportunities. This expansion into tokenization has demonstrated XRP’s versatility beyond its original design as a payment token.

Market Psychology and Trading Patterns of XRP

Trading patterns around XRP have evolved significantly, showing increased sophistication in market participation. Analysis of order book data reveals growing institutional influence, with larger block trades becoming more common. The average holding period for this currency has also increased, suggesting a shift from speculative trading to longer-term investment strategies.

Corporate Treasury Adoption

A growing number of corporations are adding XRP to their treasury operations, both as a strategic investment and as a practical tool for international operations. This trend extends beyond technology companies to include manufacturers, retailers, and service providers with global operations. The ability to maintain working capital in it while minimizing exchange rate risk has proven particularly attractive to multinational corporations.

Impact on Global Remittance Markets

XRP’s influence on global remittance markets continues to grow, with several major money transfer operators integrating this cryptocurrency-based solutions. This has particularly impacted developing economies, where traditional remittance costs can be prohibitively expensive. Countries with significant remittance flows have seen notable adoption of this currency based transfer solutions, leading to reduced costs for end-users.

Academic Research and Development

The academic community has shown increasing interest in XRP’s consensus mechanism and its implications for distributed systems. Several leading universities have established research programs focused on this technology, contributing to both theoretical understanding and practical improvements of the protocol.

Social Impact and Financial Inclusion

XRP’s role in promoting financial inclusion deserves special attention. The low transaction costs and fast settlement times have made financial services more accessible to underserved populations. Microfinance institutions and community banks have leveraged this technology to extend services to previously unbanked populations.

Conclusion: XRP’s Path Forward

XRP’s recent climb past $3 signifies a renewed phase of growth and market optimism. With positive legal resolutions, expanding institutional adoption, and continued technological advancements, the digital asset is well-positioned for future success. As the cryptocurrency market continues to mature, it’s focus on real-world utility, energy efficiency, and compliance with regulatory standards could further solidify its place as a leading digital asset in the years to come.